The key to having good financial goals is to have a good plan. A good banking solution is the foundation for a good plan.

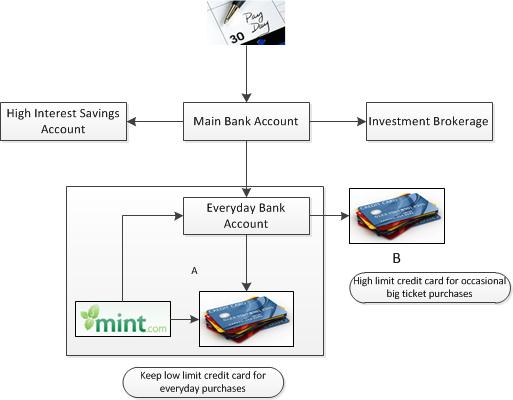

If you care at all about your finances, at the very minimal, this is what you should have:

A. If your monthly credit bills are $2000, then that single credit card limit should be around $2500-$3000

B. This credit card limit should go as high as you want. Keep this tucked away and pull it out only for occasional uses. You don’t want to connect this credit card to Mint.com in the event you need to dispute a transaction or to report fraudulent activities.

C. Keep your Main Bank Account card tucked away as well and only use online transfers between accounts.

What is the purpose of all this?

1. You manage to separate risk of losing your wallet from risk of raiding your entire bank stash. Dropped your wallet somewhere? You’ve just limited your potential loss from the tens of thousands to just one or two thousand (and that’s the worst case scenario).

2. You are able to fully utilize Mint to track your finances while still not violating PIN agreement for your high limit credit card.

3. You keep your investment account separate from your daily account as a risk precaution.

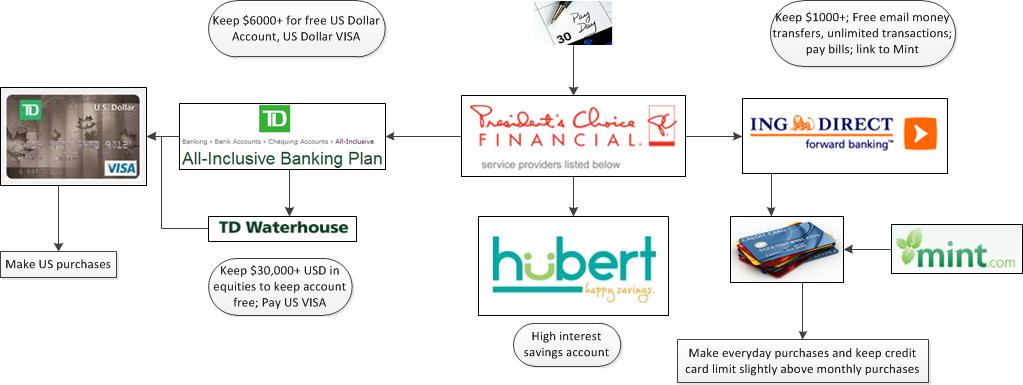

This is my personal banking setup:

For the average Joe, it does seem convoluted and over-the-top. However, I believe everyone should strive good bank account management.

1. My central bank account is President’s Choice Financial, simply because it offers unlimited links to other banks and unlimited transactions.

2. My daily finance bank is ING Direct. I pay all my bills through this bank (except USD). I email all my money via here too since it offers Free Email Money. As well, I link my Mint.Com to this bank. If it ever does get compromised, my maximum loss is several thousand (as opposed to tens of thousands).

3. If I ever need to travel down south and spend money, I have a US Dollar VISA card. This allows flexibility of exchanging for US Cash when the exchange rate is favorable.

4. Currently, I am with Hubert since it offers competitive interest rates. If I ever need to switch, I would just simply link my President’s Choice Bank with another savings Bank.

What are the benefits of having this setup?

1. I haven’t paid a single transaction fee yet. I always keep my Select Service (renamed as All Inclusive) over $5000. I always keep my brokerage well funded above margin requirements.

2. I don’t need to pay email money transfer fees. ING offers free email money transfer and I use this service every month to pay rent and such.

3. I can connect to Mint.com to track spending and not worry about security of my savings account.

What’s your setup like? How many bank accounts do you have? Feel free to share.