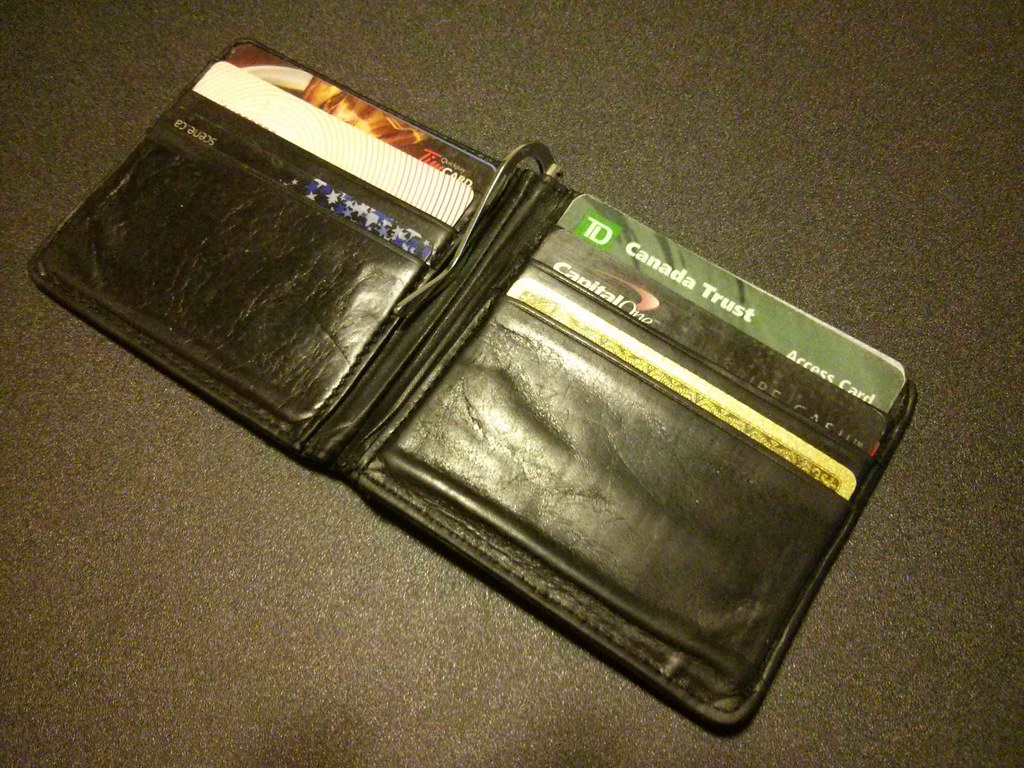

I have to admit, at it’s current state, my wallet is pretty bloated. I figured to make this post to review the contents of my wallet and whether I need the cards in there or not.

Currently, I am carrying:

1. TD Debit Bank Card- I rarely use this. However, this is an emergency precaution. If I am in urgent need of cash, I can go to any TD branch and withdraw cash without incurring any fees.

2. Capital One World Mastercard- This is my current go-to Mastercard. With an effective 1.5% rate of return and no annual fee, it is an ideal jack-of-all-trades credit card.

3. American Express Gold Card- I use this for electronic purchases (Amex offers to best consumer protection program), dining out with friends (who doesn’t enjoy flashing an “elusive” credit card every now and then?)

4. Driver’s License- This is for obvious identification purposes. Yes, I still get asked for ID when heading out to bars or casinos.

5. Target Department Card- I don’t know why I have this because I rarely shop at Target. I guess my reasoning at the time was that in the event that Target has a great deal, I don’t want to miss the additional 5% discount.

6. Starbucks Gift Card- There’s very little balance on it left and I wanted to finish it so I can get rid of it but I haven’t had the chance to hit up Starbucks yet…

7. Shopper’s Drug Mart Card- I shop there once a week to somewhat justify carrying this card

8. Air Miles Card- I shop at Metro and LCBO once a month to somewhat justify carrying this card…

Over half of those cards can be eliminated. Eventually I would like to trim it down to what I believe is the perfect wallet:

The Perfect Wallet

1. $100 Cash in denominations of (4 x $5, 2 x $10, 3 x $20)- Why so much you may ask? Well many restaurants only accept cash/debit. A night out at a bar might run you $50-$70 (even frugal people splurge sometimes!).

2. A debit card- For emergency purposes and in cash merchant only accepts debit

3. A credit card- This will be your main shopping card

4. A backup credit card- In the event that your first card is somehow rejected or unreadable, use this one. Ideally, if your first cc was a mastercard, then this one should be a Visa or Amex.

5. An ID card such as driver’s license.

The above is the absolute best minimalist wallet setup which solves 99% of your needs.

“But Savvy Buck! What about reward cards?”

They will be stored in our smartphones of course! Most reward cards offer manual input of digits. I know Esso’s Aeroplan, Metro’s Air Miles, Cineplex’s Scene Program offer manual card entry. Yes, the sacrifice is a bit of hassle each time you shop there.

In the end, you are sacrificing convenience of scanning a reward card over convenience of a much lighter wallet load.

So what’s in your wallet and what can you do without?