Globe and Mail had an article awhile ago saying that the rich benefit more from TFSA than the poor.

From the article, Who Really Benefits from TFSA:

Let’s be clear. This measure will make the rich and powerful more rich and powerful. The rest of us will be left begging for funding for basic services.

…

The TFSA should not be expanded. It should be capped.

Lifetime contributions should be limited to $50,000 — 10 years of contribution. Growth of assets in the account should be limited to $150,000 tax free. Poor people don’t gamble with their savings. It would take a long time to triple that maximum contribution when it’s growing at two or three per cent a year.

I will demonstrate how that isn’t necessarily true.

Let’s say you have a frugal low income person making $30,000 a year. Your after-tax income is $26,124, average tax rate is 12.9%, and marginal tax rate is 20.1%.

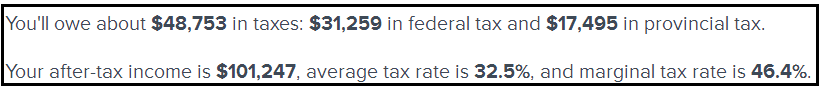

Then, let’s compare that with a high income person making $150,000 a year. His after-tax income is $101,247, average tax rate is 32.5%, and marginal tax rate is 46.4%.

For the purpose of this comparison, let’s assume that the “poor” stays “poor” and the “rich” stays “rich”. Meaning, their income doesn’t change.

Below is a chart showing what your TFSA would look like after 15 years of consistent $5,000 contribution and assuming 8% rate of return:

| Year | TFSA Total | TFSA Gain |

| 0 | $5,000.00 | $400.00 |

| 1 | $10,400.00 | $832.00 |

| 2 | $16,232.00 | $1,298.56 |

| 3 | $22,530.56 | $1,802.44 |

| 4 | $29,333.00 | $2,346.64 |

| 5 | $36,679.65 | $2,934.37 |

| 6 | $44,614.02 | $3,569.12 |

| 7 | $53,183.14 | $4,254.65 |

| 8 | $62,437.79 | $4,995.02 |

| 9 | $72,432.81 | $5,794.62 |

| 10 | $83,227.44 | $6,658.19 |

| 11 | $94,885.63 | $7,590.85 |

| 12 | $107,476.48 | $8,598.12 |

| 13 | $121,074.60 | $9,685.97 |

| 14 | $135,760.57 | $10,860.85 |

| 15 | $151,621.42 | $12,129.71 |

Let’s also assume that after 15 years, the low income person is still making $30,000 a year and the high income person is still making $80,000 a year, what are their potential tax savings? Well, both would have the TFSA size shown above.

Below is a table comparing the potential tax burden for the low income and the high income person after year 15. Take note of the cells highlighted in green and red.

| Low Income | High Income | |

| Gross Income | $30,000.00 | $150,000.00 |

| Income Tax | $3,876.00 | $48,753.00 |

| Capital Gains (Based on $151,621.42) | $12,129.00 | $12,129.00 |

| Capital Gains Tax | $1,216.00 | $2,293.00 |

| Capital Gains Tax as a Percent of Total Tax | 23.88% | 4.49% |

| Total Tax | $5,092.00 | $51,046.00 |

Had the TFSA NOT been introduced, the low income person would have paid an additional $1,216 in capital gains tax, which represents a hefty 24% INCREASE to their tax burden.

How about the wealthy person? They would have paid an additional $2,293, which represents a minuscule 4.5% INCREASE to their tax burden.

The demographic which benefits the most from TFSA would be a low income but frugal person, who is able to squirrel away the TFSA contribution limit each and every single year since inception. That is a pretty big assumption to make, but after all, we are comparing who benefits the most from TFSA…not who is able to save more.

“But Savvy Buck!” You protest, “Most low income people cannot afford to tuck away this much money every year!”

Absolutely right. But that would defeat the purpose of the question, would it not? The question was who benefits from TFSA? Surely, everyone agrees that you cannot benefit from TFSA if you don’t actually use it! Your point would be trying to get low income people to save for TFSA rather than criticizing the merits of TFSA itself.

What is the main takeaway from this article? Tax Free Savings Account is an amazing tool for the low income, only if you are frugal and max the contribution room each and every year.

Reference:

Tax calculation credits given to SimpleTax.ca

Simple Tax Calculator

Globe and Mail

Who Really Benefits from TFSA