If you are starting on your journey to becoming retired, wealthy, financially free…well I’ve come up with some major milestones and benchmarks to help you out. I am going to use a conservative 3% yield on networth.

The major milestone amounts are as follows:

$50,000 = Full Stomach:

($1250/year or $125/month)

Congratulations! You have scrimped and saved; You have gone into debt and left debt. You are now deep into the black zone with $50,000 saved. Pat yourself in the back! At this networth, you can take satisfaction knowing that you will never starve. $125/month should provide you enough for basic necessities such as rice, flour, pasta, vegetables, and perhaps occasional meat. No, you can’t shop at Whole Foods and you are going to have to stick to Walmart/discount retailer. You are gonna have to clip coupons, buy near expiring food at 50% off, but hey, you aren’t starving!

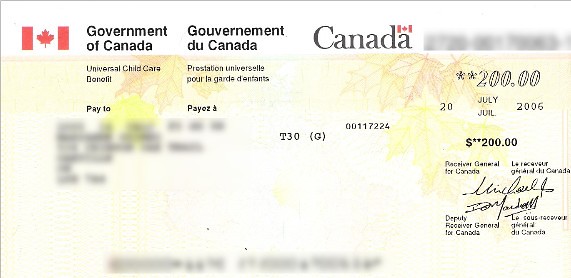

$260,000 = Welfare Independent:

($7,800/year or $650/month)

The average welfare recipient who is single with no dependants, receives about $650-$700 per month. So at this networth, you will hypothetically never need to go on welfare…because you are already receiving your very own welfare equivalent cheque coming from the bank of You & Yourself! Still, this isn’t saying much because you can only afford to pay rent at $300-$350 tops, which means you will have to live far outside of the city centre and likely with 4 other roommates in a shoddy neighbourhood.

$350,000 = Barista FI

($10,500/year or $785/month)

You have just enough for room & board, and perhaps just enough for food, yet not quite enough to cover all your expenses. You will need to pick up a temp job and do some work here and there to cover the small shortfall to coast into a comfortable retirement.

$600,000 = Minimum Wage Or Better:

($18,000/year or $1,500/month)

Based on a 35 hour work-week earning $10/hour, you will be getting around $1500/month. Isn’t that interesting? For someone with over half a million, sitting on pure dividends, you can live the life of a minimum wage worker indefinitely. On this stipend, you can afford a cheap bachelors room ($700/mo) outside the city core, and old paid-off car, and some room for miscellaneous expenses here and there. Still, take some pride knowing that you can basically fall out of your bed while earning the same amount of money as a service agent getting yelled at by annoying & hungry customers all day.

$1,000,000 = Millionaire Status:

($30,000/year or $2,500/month)

You’ve finally did it! You are part of the double comma club…the seven figure net worth…the millionaire club! Granted, a million dollars definitely doesn’t have the buying power that it used to, you should still feel proud you built your net worth to the top 4% in wealth. You are definitely now part of the elite club. However, having $2,500 in monthly income means you definitely have to budget. You will be able to afford a 2 bedroom home outside the city core, eat relatively well and have a few splurges here and there. With proper planning, you can definitely raise a family on that money.

$1,500,000 = Millionaire Next Door:

($45,000/year or $3750/month)

In all practical sense, you are effectively financially independent as you can live like a middle class indefinitely. $1.5 million generates $45,000 in dividends and capital returns which should guarantee an average income for the majority in Canada/United States. Pat yourself on the back, you have achieved what most would absolutely *kill* to have! A small house with a white picket fence is not out of the question here (except in cities like New York or San Francisco). You can afford an economy car and go on vacation several times a year.

$3,000,000 = Upper Middle Class

($90,000/year or $7,500/month)

At this income stream, you are earning as much as your average middle manager, technical specialist, or starting salary of the big name high tech developer. You can afford a mid-level car such as BMW 3 series or Cadillac CTS and live in a nice suburban 4 bedroom home outside the city (or a luxury condo in most cities).

$8,300,000 = Upper Class

($250,000/year or $21,000/month)

This income level becomes the start of upper class. Coincidentally, this wealth level also puts you in the top 1%. You are in the ranks of senior VPs in major Fortune 500 companies, medical specialists, and senior lawyers. You can afford most luxuries in life without much budgeting: private schooling, first class flights, luxury cars, and fancy restaurants.

$13,000,000 = Presidential Wealth

($390,000/year or $32,000/month)

Your dividends now puts you at par with the President’s salary, NFL minimum players. However, the difference is that you get to pop a popcorn and cash will come rolling in!