Many years ago, I posted the perfect banking solution. Well, I’m going to update it. No…tweak it, a bit.

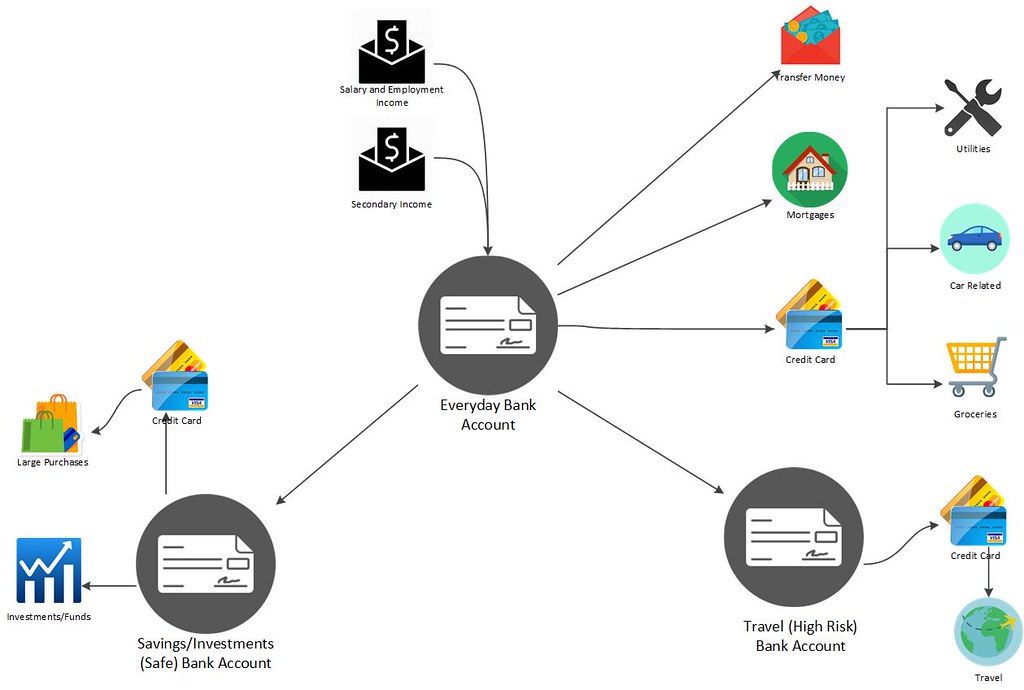

The core philosophy has remained the same and is this: Separate the daily transactions away from your large investments. Essentially, we have 3 tiers of risk:

Tier 1. Super Safe: This bank is connected to your brokerage, and thus is connected to your investments. The credit card connected to this account should be relatively high limit. Ideally, both (debt & credit) cards are tucked away in a safe drawer somewhere where you rarely pull it out. You might only use it for a large furniture purchase or a family vacation. You want to have as few transactions to this account as possible as it contains your life savings.

Tier 2. Middle Account: This bank essentially contains all of your daily transactions. The credit card limit connected to this bank account should be just high enough to fuel all your daily needs. Utility, mortgages, friend payments all goes through here. Whenever you have more than enough savings here, transfer a portion of it to your Tier 1 Account.

Tier 3. Super Risky: The third account when you are dealing with the unknown. Perhaps you are traveling to another country or an unsafe place. Take only that debit card and credit card with you. Perhaps you are dealing with a shady dealer or website, but you want to make the purchase anyways. If you are making Kijiji/Craigslist purchases, and you want to E-Transfer, use that card to pay it off. The credit card limit and debit balances should be much lower than your Tier 2 accounts. Ideally, you want a no-frills bank account with no fees and unlimited transactions.

What is the purpose of all this??

1. Separation of Risk: While you are jet-setting to another exotic location, you will have a piece of mind knowing that your investments are safe because you’ve only carried with you a low limit credit card and a bank account with a little cash. The most anyone can rob from you is whatever is in your Tier 3 bank account.

2. Easily Track Savings: If you want to see how much your networth increased or how much you saved, just open up your Tier 1 Bank Account, and tada! You can see exactly how much you saved, by year, by month, whatever you like. It won’t be convoluted with mortgage payments, transfers to friends, bill payments etc.

3. Easily See Vacation Spending: Same point as #2. Take that card with you, and you can easily see how much you spent on your vacations.

4. Connect To Mint Worry-free: Mint or any other third party budgeting app that uses login information to download your statements present itself as a risk. I only use it to analyze my spendings and I don’t need it to track my investments. Thus, I simply connect it with my Tier 2 bank accounts and credit cards and I have the piece of mind that Mint won’t have login information on my investments.

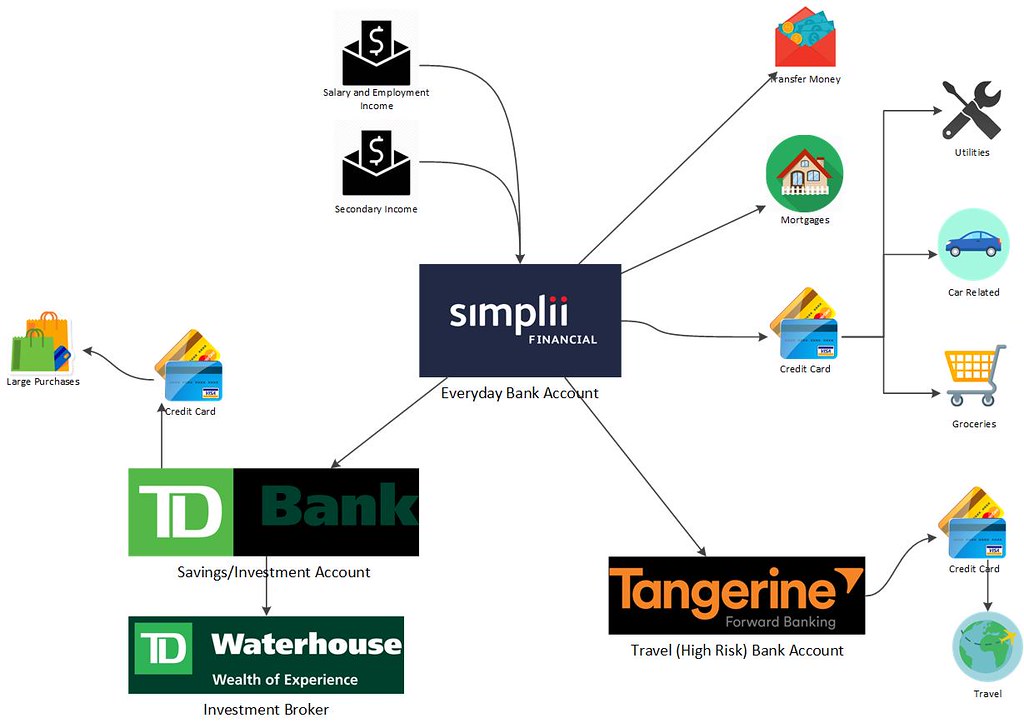

Here’s my personal implementation of my banking plan:

What’s your banking setup like? Share it with me!