It’s that time of the year again, Christmas vacation, snowbirds flocking down south. Many of us will be needing US dollars to spend south of the border. You go to the bank and get quoted a rate of 1.19 when the spot rate is around 1.16. That is almost a 3% premium! You begin to wonder, can you do better elsewhere?

Well, then, allow me to introduce you to the Norbert’s Gambit!

What is Norbert’s Gambit?

Norbert’s Gambit is an cost saving method to exchange currencies, primarily between Canadian and US dollars. It was coined by Norbert Schlenker, who was a financial planner. The simplest way to explain is to utilize stocks and ETFs that are listed in both the Toronto Stock Exchange and the New York Stock Exchange. For example, TD Bank is a publicly trading company that is listed in both TSE and the NYSE (both as ticker TD). What you want to do is purchase shares of TD on the Canadian side, ask your broker to “journal” it to your US account, and then sell the stock for US dollars.

Below, I will give a complete guide on how I used the DLR (HORIZONS U.S. DOLLAR CURRENCY) ETF to save money on Forex.

By the way, DLR is an ETF which tracks US Dollar exchange rate. DLR.U is the exact corresponding ETF which tracks the Canadian dollar exchange rate.

Preparation:

A. Make sure you have a Canadian and US trading account open with your broker

B. Make sure you have sufficient money to exchange!

Step 1: Buy DLR in your Canadian trading account

B. Thus, on Dec. 15, I bought 2100 shares of DLR at $11.59 per share costing a total of $24,339 CAD + ($9.99 trading commission)

Step 2: Call TD Waterhouse to journal your shares over as DLR.U

This should take several days to “settle”, meaning for them to approve, go through with the transaction, and actually have it appear in your account. From the above picture, I made the transaction on the 15th and it is going to be settled on the 18th.

Step 3: Sell DLR.U in your US trading account

A. I sold all 2100 shares of DLR.U at an asking price of $9.94 per share costing a total of $20,874 USD – ($9.99 trading comission)

*Note: I was trading on “margin” (aka loan) because in theory, it hasn’t settled yet. You have to have a margin account to be able to do this. Otherwise, you would have to wait until it settles, and then make the sale.

Comparison Against Other Methods

All in all, I started with $24,348.99 CAD and I ended up with $20,864.01 USD. That brings my exchange rate to 1.167.

1. Total Savings vs. Spot Rate: -$40

That is really good considering that the spot rate is 1.16477 at the time. If I had traded at SPOT RATE, I would have received $20,904.54, meaning I paid a premium of around $40 (including trading fees) to conduct this foreign exchange.

Subtract the $20 in transaction fees, and in essence, it cost me $20 above spot to trade $24,xxx. If I needed $100,000 exchanged, it probably would have just costed me a mere $100 or 0.1% in “fees”. As you can see, the real benefits show up when you need to exchange really large amounts!

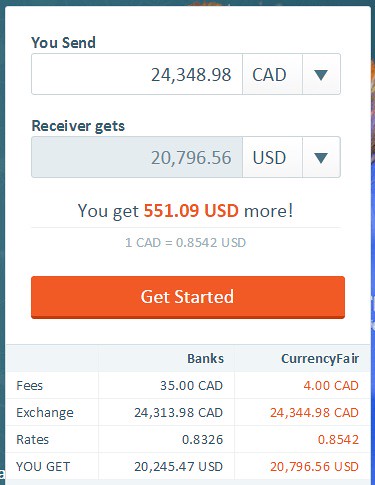

2. Total Savings vs. CurrencyFair.com: $67

CurrencyFair would have given me about $20,796 which is very similar to what Norbert’s Gambit gives. However, do note that I only converted $24,000. The differences would be more spectacular when we get into exchanging $100,000 or $200,000. Essentially, $268 or $500+ saved in fees even against a low cost currency exchange site!

3. Total Savings vs. TD Warehouse Broker Forex: $237

Let’s look at what foreign exchange at TD Waterhouse would have costed:

Using the same amount of $24,348.99 CAD, I would have ended up with $20,627.74 USD, which is a full $237 less!

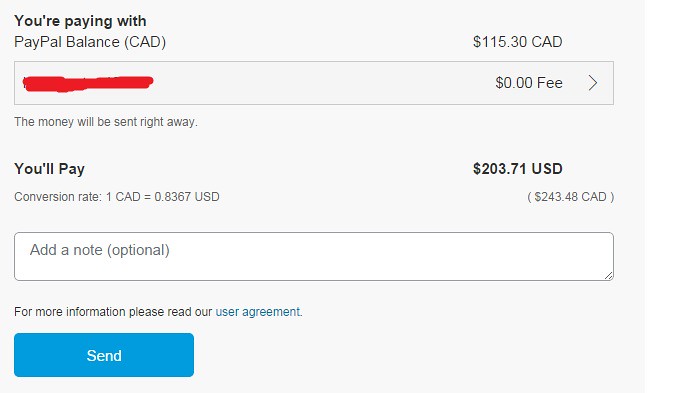

4. Total Savings vs. Paypal: $400+

*Note: I used a small number because I simply don’t leave over 24 grand sitting in my PayPal account!

Paypal slaps a 2.5% Forex Fee so I would have only received $20,371 USD had I decided to use Paypal instead.

Conclusion:

It is a great and effective way to obtain forex. However, due to the $19.99 trading cost and bid/ask spread, you should really be using this method for very large amounts, at least over $20,000. The benefits really start to shine when you conduct transactions of $100,000 or more!

Here’s a calculator that shows your effective exchange rate using Norbert’s Gambit, and how much you will save vs a retail FX transaction:

http://norbertsgambit.com

Thanks for the link; I will probably switch over some more money during the New Years