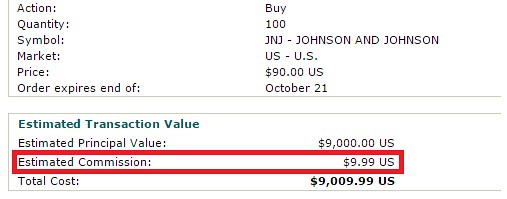

If you are starting on your journey to becoming retired, wealthy, financially free...well I've come up with some major milestones and benchmarks to help you out. I am going to use a conservative 3% yield on networth. The major milestone amounts are as follows: $50,000 = Full Stomach: ($1250/year or $125/month) Congratulations! You have scrimped and saved; You have ...