Now I am not against the idea of day trading in theory.

The stock market is comprised of average investors, who are Mom and Pops, institutional investors who are subject to many rules and regulations, and hedge funds, who are also subject to various rules and regulations. So you think to yourself, “Hey, I am my own person with my own money. I am subject to zero regulations on how I invest my money and I think I can beat all the chumps out there earning a measly 8% return year over year!”

Sounds great in theory right? If you think the market is pricing stock X at $50 a share and it should be valued at $100 a share after the inevitable earnings beat, then why shouldn’t you take the position temporarily and liquidate for a nice profit?

However, in practicality, most of us who try will be losers. You not only have to beat the market but you have to beat many “logistical barriers” which I will explain below.

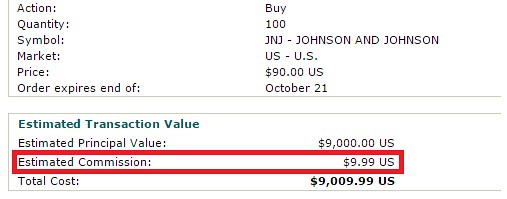

1. Transaction Fees

In simple terms, when you buy a stock and then subsequently sell it, the transaction fee is generally $20 total. So even on a $2,000 position, the fees represent 1% of your total amount! Consider that the over the long term, the typical investor should expect 8% in returns, 1% in fees is a massive chunk of your overall returns!

2. Taxes!

Each time a day trader liquidates to realize on a gain, you have to declare it as capital gains. So, a day trader who expects to be profitable, will generally pay more in taxes and have compounding work against them in the long run. A buy and hold investor will only have to pay taxes once in the end, when they finally liquidate the position after X number of years.

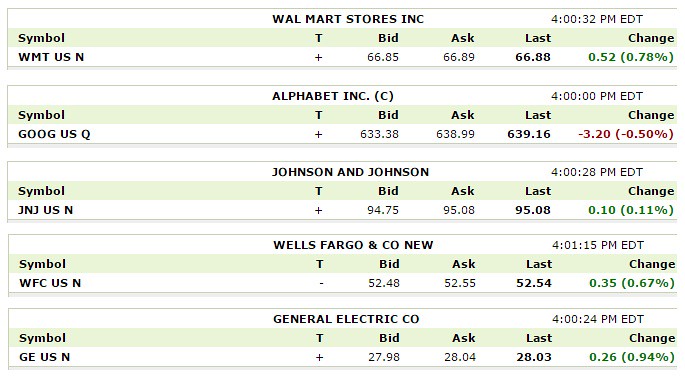

3. Bid and Ask Spread

Not only taxes and transactions fees, but each time a daytrader enters and exits a position, they are subject to the bid ask spread. Even for many liquid blue chip stocks, there is still a slight bid ask spread which takes away your returns.

Walmart: 0.045%

Alphabet: 0.89%

Johnson and Johnson: 0.35%

Wells Fargo Corp: 0.13%

General Electric: 0.21%

I don’t have any actual studies on bid ask spread for blue chip stocks, but for sake of this article, I will say there’s an industry wide 0.3% bid/ask spread for each transaction.

Example Scenario

Consider this scenario: You have a stock A worth $10. Each month, the stock either doubles (x2) and almost halves (x0.55). What I am illustrating is that over the long run, after the wild fluctuations, this stock is generally going up.

Each month, the day trader sells his position and re-buys the position.

After a certain number of months, what is the discrepancy of money between the day trader and the long term investor?

Month | Stock Price | Shares | DT Total | DT Bid Ask (0.994) | DT Trx Fee (-$20) | DT Taxes |

|---|---|---|---|---|---|---|

| 1 | $100.00 | 100.00 | $10,000.00 | $10,000.00 | $10,000.00 | $10,000.00 |

| 2 | $200.00 | 100.00 | $20,000.00 | $19,880.00 | $19,860.00 | $19,860.00 |

| 3 | $110.00 | 99.30 | $10,923.00 | $10,857.46 | $10,837.46 | $10,837.46 |

| 4 | $220.00 | 98.52 | $21,674.92 | $21,544.87 | $21,524.87 | $21,524.87 |

| 5 | $121.00 | 97.84 | $11,838.68 | $11,767.65 | $11,747.65 | $11,747.65 |

| 6 | $242.00 | 97.09 | $23,495.30 | $23,354.33 | $23,334.33 | $23,334.33 |

| 7 | $133.10 | 96.42 | $12,833.88 | $12,756.88 | $12,736.88 | $12,736.88 |

| 8 | $266.20 | 95.69 | $25,473.75 | $25,320.91 | $25,300.91 | $25,300.91 |

| 9 | $146.41 | 95.04 | $13,915.50 | $13,832.01 | $13,812.01 | $13,812.01 |

| 10 | $292.82 | 94.34 | $27,624.01 | $27,458.27 | $27,438.27 | $27,438.27 |

| 11 | $161.05 | 93.70 | $15,091.05 | $15,000.50 | $14,980.50 | $14,980.50 |

| 12 | $322.10 | 93.02 | $29,961.00 | $29,781.24 | $29,761.24 | $26,797.05 |

| 13 | $177.16 | 83.19 | $14,738.38 | $14,649.95 | $14,629.95 | $14,629.95 |

| 14 | $354.31 | 82.58 | $29,259.90 | $29,084.34 | $29,064.34 | $29,064.34 |

| 15 | $194.87 | 82.03 | $15,985.39 | $15,889.47 | $15,869.47 | $15,869.47 |

| 16 | $389.74 | 81.44 | $31,738.95 | $31,548.51 | $31,528.51 | $31,528.51 |

| 17 | $214.36 | 80.90 | $17,340.68 | $17,236.64 | $17,216.64 | $17,216.64 |

| 18 | $428.72 | 80.32 | $34,433.28 | $34,226.68 | $34,206.68 | $34,206.68 |

| 19 | $235.79 | 79.79 | $18,813.67 | $18,700.79 | $18,680.79 | $18,680.79 |

| 20 | $471.59 | 79.22 | $37,361.58 | $37,137.41 | $37,117.41 | $37,117.41 |

| 21 | $259.37 | 78.71 | $20,414.58 | $20,292.09 | $20,272.09 | $20,272.09 |

| 22 | $518.75 | 78.16 | $40,544.18 | $40,300.91 | $40,280.91 | $40,280.91 |

| 23 | $285.31 | 77.65 | $22,154.50 | $22,021.57 | $22,001.57 | $22,001.57 |

| 24 | $570.62 | 77.11 | $44,003.15 | $43,739.13 | $43,719.13 | $41,180.82 |

In this table above, I am applying a 0.6% bid ask spread (0.3% times 2), $20 transaction fee for buying/selling, and a 15% tax after the 12 month cycle.

Notice in the final line, our hypothetical day trader is receiving only $41,180 with 77 shares trading at $570.62.

So how much would the buy and hold investor have? He would have $57,042 before taxes and almost $50,000 after taxes.

Day trader: $41,180.82

Buy and Hold Investor: $49,985.7

As you can see, after a mere 2 years, the buy and hold investor has 21% more money than the day trader! A day trader is really going against the wind to beat the market!

Bottom Line

In our sample scenario, the day trader has to be correct/wrong on a 60%/40% basis to simply BREAK EVEN against a buy-and-hold investor.