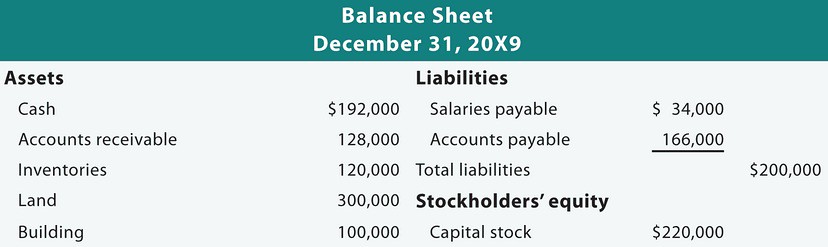

Prelude: I will be analyzing sample individuals and evaluate their finances as if they were a company. How do they stack up if their finances were publicly available? Would investors "buy" their shares? Name: Francis Collins Age: 26 Income: $46,000 Monthly After Tax Income: $3000 Monthly Expenses: $1475 Home: No, renting at $400 per month. Summary: Francis Collins is a young professional who has ...