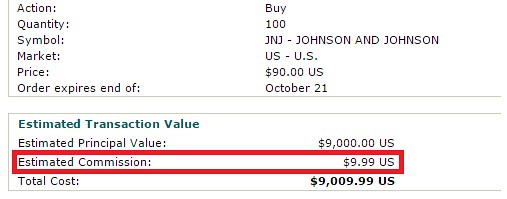

Now I am not against the idea of day trading in theory. The stock market is comprised of average investors, who are Mom and Pops, institutional investors who are subject to many rules and regulations, and hedge funds, who are also subject to various rules and regulations. So you think to yourself, "Hey, I am my ...